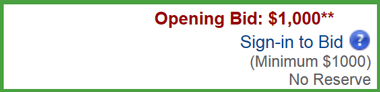

Daniel Grant, writing for Gallerist, published an interesting article a few days ago about auction houses, reserves, and transparency (see “How Low Can You Go?: Should Auction Reserve Prices Be More Transparent?”). In his feature, he talks about how in nearly all cases, auction houses do not openly disclose the reserve (the lowest amount for which an item will sell at auction), and provides a variety of differing perspectives on how this practice impacts their respective markets and its participants. Of the auction houses specifically discussed in the article, only one – Heritage Auction – makes it known to the public what the reserve price is for every item that they offer for sale.

As these issues have been an ongoing area of concern and discussion with the Original Prop Blog, I thought it would be worthwhile to highlight the Gallerist feature for my readers to take a lot at and consider:

Funny enough, Heritage Auctions – who publish their reserves on their website – were in the center of a PR flap as a result of a lawsuit from a former employee, who made claims that Heritage was making house bids using the pseudonym “N.P. Gresham”. In their defense, Heritage went on the record explaining that the direct purchase and sale division within the company would place bids on items at their auctions prior to opening bidding.

One interesting trend in this particular art market has been what I term “jackpot” estimates – estimates that are so high that the seller/consignor is more or less hoping for that one bidder to make the sale. Which has made many of the public auctions for high end entertainment memorabilia more of a “buy it now” (to borrow the idea from eBay) than a true auction, letting the market set the market price.

This has in the past two years resulted in some adverse consequences, and a downward trending of values (in my own personal opinion).

Interestingly, and to their credit, the major player employing such a strategy, Profiles in History, has with their latest Hollywood Auction set for later this month seemingly reversed this course a bit, as the estimates (and thus reserves, which maxes out at the low end of the estimate) seem to be notably lower than in their past few auctions.

It will be interesting to watch that particular sale at the end of the month to see how they fare overall with a change in strategy.

Jason DeBord