This week The New York Times published an interesting article (“As Art Values Rise, So Do Concerns About Market’s Oversight”) about customs in the high end art market auction world that are not favorable to consumers. Though the article is specific to the art market and New York (and their own laws, rules, and regulations), some of the issues are very much the same ones we face in the original film and television artifacts market, and is “must” reading for anyone involved in buying and selling original TV and movie props, costumes and other production material sold in the marketplace.

The full article written by Robin Pogrebin and Kevin Flynn can be read in its entirety at www.nytimes.com:

Below is an excerpt of the opening section of the four page article:

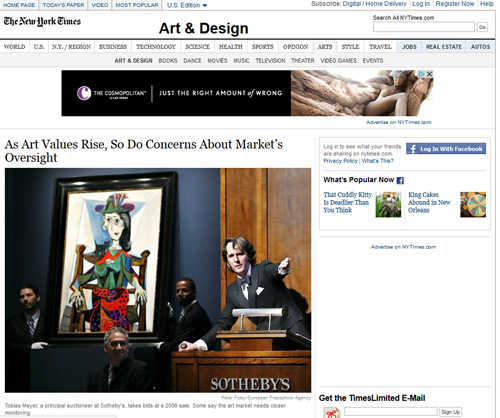

As Art Values Rise, So Do Concerns About Market’s Oversight

When some of the world’s richest people gather for the glittering New York auction season this spring, they will spend hundreds of millions of dollars in an art market that allows opaque transactions and has few outside monitors.

At major auctions the first bids announced for a piece are typically fictional — numbers pulled from the air by the auctioneer to jump-start bidding.

Collectors can find themselves being bid up by someone who, in exchange for agreeing in advance to pay a set amount for a work, is promised a cut of anything that exceeds that price.

And year round, galleries ignore with impunity a 42-year-old law that says they must post their prices.

Art sales in New York, at galleries or at auction, are estimated at $8 billion a year. Yet the last significant change in the city’s auction regulations took effect more than two decades ago, when the value of transactions was less than half of what it is today.

Many in the art world insist there is no need for further scrutiny of a market that prompts few consumer complaints and is vital to the New York economy. But other veterans of the business say there is mounting concern that monitoring has not kept pace with the increasing treatment of art as a commodity.

“The art world feels like the private equity market of the ’80s and the hedge funds of the ’90s,” James R. Hedges IV, a New York collector and financier, said. “It’s got practically no oversight or regulation.”

For two decades some New York State lawmakers have been trying to curb the practice known as “chandelier bidding,” a bit of art-market theater in which auctioneers begin a sale by pretending to spot bids in the room. In reality the auctioneers are often pointing at nothing more than the light fixtures.

“The time has come to give up this fiction that there are actual real bidders,” said David Nash, a gallery owner who spent 35 years as a top executive with Sotheby’s.

But nine bills submitted in Albany over the years to ban the practice failed. So today, in a city that seeks to regulate soda consumption, chandelier bidding remains 100 percent legal. The law says auctioneers can announce such bids as long as they stop before reaching a sale item’s reserve price, the confidential minimum amount that sellers have agreed to accept.

Auction houses say that the bidding practice is harmless, fully disclosed and widely understood by collectors, and that it protects the seller by, among other things, preserving the drama that draws buyers to a sale.

“People like to say that the art market is unregulated,” said Jane A. Levine, senior vice president and compliance director for Sotheby’s. “Nothing could be further from the truth. There are bespoke auction rules that cover this very tiny market that actually do govern the auction process.”

The New York City Consumer Affairs Department, which oversees the art market, reports few complaints from buyers or sellers, and auctioneers point to additional consumer protections provided by the state Uniform Commercial Code.

Auction officials say most criticism of their practices comes from gallery owners — their rivals for sales — who they say operate without oversight. “The dealers are not regulated at all,” said Patricia G. Hambrecht, chief business development officer for the Phillips auction house.

Some perceptions of the market as an insiders’ game stem from recent lawsuits against galleries, including three by collectors who accused Knoedler & Company, now defunct, of fraud.

“Is there any reason to believe that regulating the art market will be any more effective than regulating the financial markets has been?” asked Jonathan Brown, a professor at New York University’s Institute of Fine Arts. “Many of the players are identical.”

But others say that, given the money involved and the number of newly wealthy buyers, stricter rules are a must.

“Ideally any tightening of the rules would be self-imposed,” said Michael Plummer, a former Christie’s executive who is now a principal in Artvest Partners, an art advisory company. “Unfortunately I don’t think the markets are going to have the discipline to do that.”

The Original Prop Blog has published articles in the past about “sham” or “chandelier” bids by auctioneers without disclosure, and related legislative efforts in New York. (see “Update on New York State Assembly Bill A01730/S4313B: Seeks More Transparency For Auction Houses”).

Jason DeBord