Back in 2008, the Original Prop Blog published an article about “Buyer’s Premiums” assessed by the major auction houses in the marketplace (see Auction House Buyer’s Premiums: On The Rise). With their upcoming Debbie Reyonlds sale in June, Profiles in History raised their rates by 5%, so I thought it would be an appropriate time to revisit the topic, as well as compare and contrast with findings from the article published May 30, 2008, with updates as of today, May 31, 2011 – three years later.

Note: I did send an inquiry to Profiles in History on 5/23 to determine whether the Buyer’s Premium increase was a fixed increase going forward or terms exclusive to the Debbie Reynolds auction, but have not yet received a response.

The following is a listing of some of the auction houses that hold or have held entertainment memorabilia sale events and the current stated Buyer’s Premium fee structures (in future or most recent auction events). Information from the 2008 article are also include as a point of comparison

Bonhams

Bonhams UK – May 2008

- 20%: On the first £250,000 of the hammer price

- 12%: On the excess over £250,000 of the hammer price

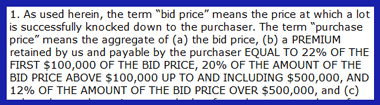

Bonhams U.S. – May 2008

- 22%: Of the first $100,000 of the bid price

- 20%: Of the amount of the bid price above $100,000 up to and including $500,000

- 12%: Of the amount of the bid price over $500,000

Bonhams UK – May 2011 (see Bonhams.com)

- 20%: On the first £250,000 of the hammer price

- 12%: On the excess over £250,000 of the hammer price

Bonhams U.S. – May 2011 (see Bonhams.com)

- 22%: Of the first $100,000 of the bid price

- 20%: Of the amount of the bid price above $100,000 up to and including $500,000

- 12%: Of the amount of the bid price over $500,000

Christie’s

Christie’s UK – May 2008

- 25%: Up to £25,000

- 20%: £25,001 – £500,000

- 12%: £500,001 and above

Christie’s U.S. – May 2008

- 25%: Up to $50,000

- 20%: $50,001 – $1,000,000

- 12%: $1,000,001 and up

Christie’s UK – May 2011 (see Christies.com)

- 25%: Up to £25,000

- 20%: £25,001 – £500,000

- 12%: £500,001 and above

Christie’s U.S. – May 2011 (see Christies.com)

- 25%: Up to $50,000

- 20%: $50,001 – $1,000,000

- 12%: $1,000,001 and up

Heritage Auction Galleries

Heritage Auction Galleries – May 2008

- 19.5% (22.5% eBay Live Auctions)

Heritage Auction Galleries – May 2011 (see HA.com)

- 19.5% ($14.00 minimum per lot; note that Heritage now uses their own “Heritage Live” in place of the now defunct eBay Live Auctions)

Hollywood Roadshow, now Hollywood Live Auction, AKA Hollywood Entertainment Auction (Premiere Props)

Hollywood Roadshow – May 2008

- 13%: Floor

- 18%: Phone, eBay Live Auctions

Hollywood Entertainment Auction (see PremiereProps.com) – May 2011

- 18%

- 20%: Online via iCollector or LiveAuctioneers

- An additional fee of 2.5% charged when using credit or PayPal for the amount of $5,000 and over

Julien’s Auctions

Julien’s Auctions – May 2008

- 25% (27.5% online bidding): Up to $49,999

- 20% (22.5% online): $50,000 and higher

Julien’s Auctions – May 2011 (see Juliens.com)

- 25% (28% online bidding): Up to $49,999

- 20% (23% online): $50,000 and higher

Profiles in History

Profiles in History – May 2008

- 15%: Cash

- 18%: Credit Card

- 20%: eBay Live Auctions (note that when switched to iCollector/Live Auctioneers, this was at times 18%)

Profiles in History – May 2011 (see ProfilesInHistory.com)

- 20%: Cash or Valid Check

- 23%: Credit Card

- 23%: iCollector

Sotheby’s

Sotheby’s U.S. – May 2008

- 25%: $20,000

- 20%: above $20,000 – $500,000

- 12%: above $500,000

Sotheby’s UK – May 2008

- 25%: up to GBP 10,000

- 20%: above GBP 10,000 – GBP 250,000

- 12%: above GBP 250,000

Sotheby’s U.S. – May 2011 (see Sothebys.com)

- 25%: $50,000

- 20%: above $50,000 – $1,000,000

- 12%: above $1,000,000

Sotheby’s UK – May 2011 (see Sothebys.com)

- 25%: up to GBP 25,000

- 20%: above GBP 25,000 – GBP 500,000

- 12%: above GBP 500,000

Auction House Bidding/Buying Considerations

For those unfamiliar with participating in auction house events, it is important to consider the impact of the Buyer’s Premium, as well as other costs in addition to the “hammer price” (the winning bid amount at auction).

Other costs can be incurred via sales tax and VAT (value added tax), and fees related to customs/importation, depending on the event venue and your place of residence. Of course, if bidding off site (phone, fax, or Internet), shipping costs can be higher than you might expect as well, though some auction houses allow for winning bidders to make alternate, third party arrangements.

Also of note is the different Buyer’s Premium scale based on method of bidding and/or method of payment, depending on the Auction House and their specific Terms.

All of these factors should be investigated and taken under consideration before bidding in an auction, as it can affect the total cost of the item significantly.

As an example, if one were to bid on an item at auction, and win with a $10,000 hammer price, how could the Buyer’s Premium affect the price paid to the auction house?

With Bonhams, the total amount paid would be $12,000 (plus shipping and VAT, as applicable).

The same item for the same hammer price at Christie’s, Julien’s, or Sotheby’s would amount to $12,500 (plus additional costs). If buying online with Julien’s, $12,800.

Heritage would charge $11,950.

Hollywood Entertainment Auction (Premiere Props) would charge $11,800 if paid by cash in person, $12,050 if won in person and paid by credit card or PayPal, $12,000 if won online and paid by cash, and $12,250 online and paid with credit card or PayPal.

If offered by Profiles in History, the Buyer’s Premium and hammer price would be $12,000 if paying cash or with valid check or $12,300 if using online bidding and/or paying with credit card.

So without taking potential sales tax, VAT, shipping charges, or any other fees into consideration, a $10,000 win at auction would cost the buyer anywhere from $11,800 to $12,800, depending on the auction house and bidding method (floor, phone/fax, online) and payment (cash, credit card) – an additional $1,800 to $2,800 (18%-28%). So even with a $10,000 purchase, the Buyer’s Premium can vary by 10% with this example (though this swing is not apples to apples, in that it takes the lowest “in person”/cash fee against the highest “online”/credit fee).

In any event, it is advisable that auction participants be cognizant of fees and options associated with any sale event in which they might participate to understand the true cost of an item.

Jason De Bord