The Wall Street Journal and the Knoxville News Sentinel both report that Debbie Reynolds’ Hollywood Motion Picture and Television Museum filed its Chapter 11 plan of reorganization in a Los Angeles bankruptcy court last week, and that “[t]he plan calls for the completion of the museum’s construction, aims to resolve a long-running legal dispute, promises to pay creditors in full and hopes to put Reynolds’ substantial collection… on public view for the first time in more than 10 years“.

As reported last June, the Hollywood Motion Picture and Television Museum, founded by Debbie Reynolds to exhibit her collection of original Hollywood memorabilia, had sought Chapter 11 protection.

The Original Prop Blog had reported on the construction of the museum back in 2008 (see The Debbie Reynolds Hollywood Motion Picture Museum), which was scheduled to debut in Fall 2008 as part of the Belle Island Village.

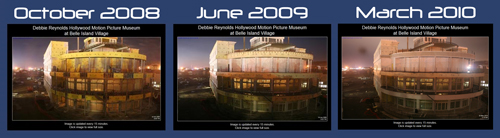

In reviewing the official website, HMPC.tv, it appears that the museum complex is still under construction, with not much progress made since June 2009:

Per the Wall Street Journal report:

Reynolds first opened the museum in a Las Vegas hotel in the early 1990s, but it closed in 1997 upon the hotel’s bankruptcy filing. The “Singin’ In The Rain” actress won a spot in a new Hollywood development, slated to open in 2004. However, that deal didn’t pan out, as the museum’s lender said it would no longer fund the museum’s construction, leaving the museum unable to build its space and pay the $1.6 million bridge loan it took out from another lender, Gregory Orman. That loan eventually became the center of legal battles between the museum and Orman, who accused the museum of defaulting on the loan. While those battles waged, the museum signed another deal to anchor Belle Island Village, a proposed resort destination in Pigeon Forge, Tenn., (near Dollywood). That, too, met with trouble, and eventually construction lender Regions Bank foreclosed on the unfinished development last year. The museum itself sought Chapter 11 protection in June.

According to the museum, Regions Bank in January agreed to sell Belle Island Village to Tennessee Investment Partners LLC for $19.5 million in a deal slated to close by March 31. The buyer is partially owned by Tennessee-based real estate investment firm Matisse Capital LLC and by Belle Island Village’s original developer. The buyer intends to reinstate the museum as the development’s anchor tenant and is promising to advance the museum enough cash to cover Orman’s claim, including principal, non-default-rate interest and his attorneys’ fees.

The report closes noting that if the plan “doesn’t work out, the museum warned it would liquidate, hiring an auction house to sell off Reynolds’ collection until enough proceeds are generated to pay creditors”.

Jason DeBord