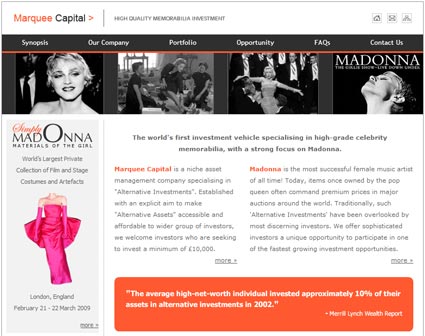

There is often a preoccupation with “value” in mainstream media coverage of the original prop collecting hobby. Today there has been a lot of little news bytes with regards to a company called “Marquee Capital” and the announcement of an exhibition of “film and stage costumes and artefacts” from Madonna. I actually found reading about the business itself on the MarqueeCapital.com website more interesting – building a business on the acquisition of entertainment memorabilia as “alternative investments”.

The promoted exhibit, “Simply Madonna: Materials of the Girl”, is touted as “the world’s largest private collection of Madonna’s film and stage costumes and artefacts”, which will run for a month between February 21 – March 22, 2009 at The Old Truman Brewery in London.

But the press hubbub seemed to be more about the company behind the exhibit, and, of course, the value of original pop memorabilia.

The Marquee Capital site describes their business as follows on the About Us page:

Marquee Capital is a niche asset management company specialising in alternative investments. Alternative investments or assets are defined as rare stamps, celebrity memorabilia, autographs, etc.

Marquee Capital was established with an explicit aim to make alternative assets accessible and affordable to a wider group of investors. We welcome investors who are seeking to invest a minimum of £10,000. As of August 2008, the company has already raised more than £450,000 in capital from private investors. With contacts all over the world, across dealer networks and reputable auction houses, our management team is ready to make a real inroad into alternative investments.

Marquee Capital has established the world’s first investment vehicle specialising in celebrity memorabilia, with a strong focus on Madonna. The company currently owns a number of exclusive assets, once belonging to the queen of pop. For example, in 2006, Marquee Capital acquired the Marilyn Monroe dress worn by Madonna in her 1985 pop video, ‘Material Girl’. Just like Marilyn Monroe assets today, given Madonna’s unrivalled fame, fortune and success, the company is expecting a healthy return on Madonna assets in the future. Although the company is diversifying its assets, 80% of the assets (as of August 2008) are invested in Madonna memorabilia.

The company has five Directors, all of whom have a significant in the company.

I have covered some past mainstream media news coverage that has touched on the notion of pop memorabilia as investments – from the recent feature by Mr. Markowitz with his wholesale dismissal of the entire pursuit of prop collecting (see Jack Markowitz, The Pittsburgh Tribune-Review: Movie Props are Silly Junk) to more positive and well researched pieces recognizing that as newer generations become older, there is a shift in what people are nostalgic for and interesting in collection (see Condé Nast Portfolio – “Reality’s Bites”) to the typical “what is this one worth?”-style of reporting (see Prop Store Featured On BBC’s “The One Show”).

It seems the aim of this business, Marquee Capital, is to commodify collectibles into values by which people can collectively invest in a mutual collection, of sorts. Personally, it sounds like participating in the hobby and squeezing every last ounce of fun out of it, but that’s just my opinion and perspective – I’ve never been interested in stocks and bonds, etc, so this approach to the hobby is about as counter-intuitive to my own interests as I can imagine.

In spite of my own differing opinions, digging deeper into the Marquee Capital site is particularly intriguing, though wading through terms and concepts such as “certified high net worth”, “small percentage of their overall portfolio”, “excluding pension and insurance benefits”, “financial promotion”, “minimum first time investment”, etc. makes me lose focus quickly.

Skipping to the FAQs page provides a more accessible overview of what this company is about – in short, investing money into a company who in turn acquires entertainment memorabilia to hold long term as well as trying to leverage assets to generate income via exhibitions, etc. I found the following excerpts from this page the most interesting:

Q7: How do you know the assets you are acquiring are genuine?

Marquee Capital only purchases assets from reputable dealers and auction houses. Each asset is always accompanied by a Certificate of Authenticity that unconditionally guarantees the authenticity of the asset. Moreover, Marquee Capital conducts extensive research on each asset to validate authenticity such as background and ownership checks, etc.

In my research, auction houses typically do not issue COAs nor guarantees with original props and wardrobe sold in their events. Having said that, I’m unfamiliar with the Rock and Roll and other related fields, so I can’t really speak to whether auction house terms and policies for those other areas of collecting are consistent (though I would imagine that they are).

Q12: What experience does the management team have in investing in alternative assets?

Buying memorabilia requires experience. It is very easy for the inexperienced to inadvertently either purchase a fake or pay too much for an asset. Our Chief Executive has been collecting memorabilia since the age of 15. Moreover, over the past few years, he has been actively building relationships with dealers and auction houses across the world. He also has considerable experience in buying and selling celebrity memorabilia. As of August 2008, our CEO is the single largest shareholder in the company.

I found it odd that the CEO and his experience is the foundation of the endeavor, and I could not find his name on the Marquee Capital website.

Q14: The value of Alternative Assets are purely subjective. How will you value the assets owned by the company and ensure any subsequent increase in the company share price reflects the true value of the assets?

By their very nature, “Alternative Assets” such a one-off celebrity dress worn in a pop video are difficult to value. The Board of Directors in consultation with its Auditors, have agreed a valuation methodology that it feels is fair and equitable to existing and new investors. We plan to value the assets owned by the company every year. The company will develop a market basket with a representative sample of memorabilia items. The market basket will be appraised every September by a reputable dealer based in London. Once the valuation of the portfolio is complete, the weighted average increase will be applied to the share price for the proceeding year. For example, if the weighted average increase is 10%, then the share price for the following year will correspondingly increase by 10%. Therefore, under this example, all new shares will have a 10% premium attached to them.

This is interesting to me because I think that an accurate appraisal of original props and wardrobe from film and television – to the point of 10% fluctuations – is unrealistic. Many pieces are one of a kind, and the market is still in it’s infancy, where every bidder counts, and one collector participating or not participating in a particular auction lot can affect the market price significantly, as would other factors, such as the discovery of a second or additional copies of a key prop whereas previously there were only one or a few. And the only way to know the true value of a piece is to sell it publicly at a well-publicized auction event, and even then, once it sells, it is still a guess as to what the value is – if a high end piece, once sold one of the few high end bidders will be satisfied, so the next (if there is one) version of the same piece may sell for less in the future.

In any event, the site and concepts are interesting to look into, but as I said, this purely investment-minded and theoretical ownership approach to entertainment memorabilia is definitely not one that is consistent with my own personal tastes and aspirations of what the pursuit of collecting and archiving props is all about. Having said that, if they purchase quality pieces, keep them well-preserved, and periodically share them with the public via exhibits, that is something that I can very much be in support of and respect as a collector. But that aspect sounds as though it is ancillary to more profit-minded objectives.

Jason De Bord